Hedging Calculator - Know your Trading Profits - With the hedging calculator you can see how you can guarantee back or lay profit on your live bets. Enter your bets and see how much to you need hedge. Also know as a lay bet calculator. Here's how to use the hedging calculator for trades in which you lay first, for example, LTD: Click the 'Laying First' button. Enter the 'Lay Price' (decimal odds), 'Lay Stake' and 'Back Price' (decimal odds). Enter a value for betting exchange commission if you wish. Our hedging calculator and arbitrage bet calculator allow you to insert decimal odds or American odds, as we know that some arbitrage bettors prefer to use decimal odds when calculating a bet. Making a bet can be confusing. Follow these simple steps to figure out how much to bet. Select a bet amount in the left column. Select a bet type in the right column. Select the horses to include in the wager. The total cost of the ticket will appear next to the words Ticket Cost. By inputting the odds, the probability of the event occurring and your betting balance, you will be able to determine the amount you should wager on the event. The fractional Kelly betting input is a way to change how aggressive or conservative you are with your wagering (1 being the standard and moving towards 0 the more conservative you wish.

- Gambling Hedge Calculator

- Gambling Hedge Calculator Estimate

- Gambling Hedge Calculator Present Value

- Aus Sports Betting Hedge Calculator

- Gambling Hedge Calculator For Dummies

In sports betting, hedging a bet means betting both sides of a game to safe guard against a loss.

Let's say at the start of the American football season you put $1,000 on an 8 to 1 shot winning the Super Bowl. They eventually make the Super Bowl as the favorites. The night of the game their opponent is 2 to 1. If you now bet $3,000 on their opponent (this being the hedge bet) you are guaranteed $5,000 profit no matter which team wins.

Another example is having 5% of your bankroll on a 1 to 5 favorite. The game doesn't start well, and you end up using in-play betting to lock in a 1% loss. In this case by hedging you surrendered 1% of your bankroll to safe guard the 4% that was previously at risk.

The above scenarios are reasonable for even professional bettors to find themselves in. In this article I provide the math for calculating hedge stakes, and also discuss when it is strategically correct to do so. First, I cover another frequent hedging scenario that is almost exclusive to novice bettors. As this is a very common mistake I go into detail explaining it.

Hedging Parlay Bets

As a moderator of one betting forum, and a long time regular posters on others, I often see posts that are along the lines of:

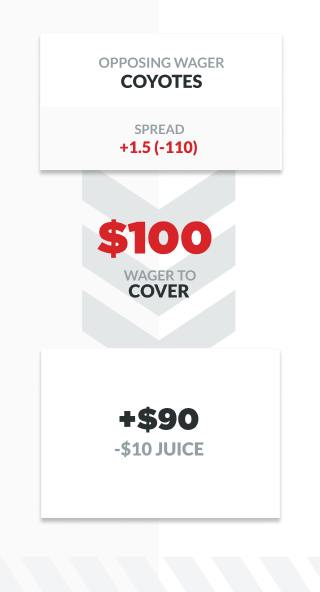

'I bet $100 on a 6 team parlay (accumulator) that pays 45/1. The first five teams have won and the other is playing tonight. Should I bet their opponent at -110 to lock in a guaranteed win? If so for how much?'

It is very common for recreational bettors to add an additional team to their parlays with the intention of hedging it back should it get that far. If you are someone who does this, please read closely.

Understand that a parlay bet is nothing more than rolling a stake plus win forward again and again. Let's look how it works on $100 using 6 bets with American odds -110.

– Bet1: $100 to win $90.91 – if win you have $190.91

– Bet2: $190.91 to win $173.55– if win you have $364.46

– Bet3: $364.46 to win $331.33 – if win you have $695.79

– Bet4: $695.79 to win $632.54 –if win you have $1,328.33

– Bet5: $1,328.33 to win $1,207.57 –if win you have $2,535.91

– Bet6: $2,535.91 to win $2,305.37 – if win you have $4,841.27

If you win all 6 you have 48.41 times you stake. As 1 was your stake this means the payout is 47.41 to 1 which in American odds is +4741. At Bovada, 5Dimes, and Bookmaker this is exactly what a 6 teamer pays when all point spreads are -110. However, there are other sites that essentially cheat players by using fixed odds. Examples include BetOnline who pays 45/1 and Topbet 40/1 on 6-teamers. This is legit as each has these payouts built it into their rules, but it is this way only to take advantage of novice bettors that don't know any better. www.bovada.lv is a much better choice.

So, the first mistake was likely getting +4500 when +4741 was available. But, even if you had the full pay ($100 to win $4,741.27), let's look what happens when you hedge. In order to lock it in so the profit is the same no matter which team wins you'll now need to stake $2,535.90 on their opponent winning at American odds -110.

This gives two bets. These are:

– Bet 1 = $100 to win $4741.27

– Bet 2 = $ 2,535.90 to win $2,305.36

If Bet 1 wins, on the winning bet you get +$4741.27 and -$2535.90 on the losing one = +$2,205.37

If Bet 2 wins you get +$2305.36 on the winning one and -$100 on the losing one = +$2,205.36

Aside from the penny that can't be split, you've now hedged in such a way the profit is the same regardless of which team wins. Now here's the kicker. Go back up to where I showed manually rolling forward stake plus win and note: 'Bet5: $1,328.33 to win $1,207.57 –if win you have $2,535.91'. Do you see what a huge mistake adding extra teams to parlays only to hedge is?

If you had bet a 5-team parlay $100 turns to $2,535.91 when all 5 win. By adding a sixth team and then hedging it back, instead those same five teams winning gives you a return of only $2,205.36. That is $330.55 thrown away for no reasons at all.

Please note that even when dealing with moneyline parlays where each has different odds the result is the same. It doesn't matter the order or anything else. The parlay payout is the same as rolling over stake plus win on each bet, no matter what odds you select.

If you're in this scenario now, then perhaps you should hedge. This is covered in the next section. Just hopefully this section has resulted in lesson learned and you will avoid getting into the same situation in the future.

When Does Hedging Make Sense

Anytime the stakes involved are significant a hedge is ideal. There is a lot of poor advice on forums that explain otherwise by stressing the importance of expected value. This is where understanding Kelly Criterion helps. In that article, in laymen terms I explain the importance of maximizing expected growth (EG) over expected value (EV). This is also how advanced bettors should determine their hedge stakes. That aside, here are some general bullet points.

When to Hedge:

1) When the second wager is also +EV

This can happen for a variety of reasons. Perhaps you found an arbitrage situation and are betting both simultaneously. Perhaps, you're watching television and see a player is injured and can act in those few seconds before the in-play betting odds adjust.

2) When hedging was a consideration before you placed your original bet

There are countless reasons to make over-bets. Perhaps you see a line of -6.5 in a football match and strongly suspect it will move to -7, but probably won't move to -6. Here you might over-bet with the plan to buy it back later for a profit or for a +EV middle attempt. There are many other scenarios with future bets, live trading on betting exchanges, etc. where hedging was a known option at the time the original bet was placed.

3) Anytime you're overexposed

Again, this can be from foolishly adding additional teams to parlays. It might also be because an outside circumstance required you to reduce your bankroll while bets were pending. It could also be that an arbitrage or over-bet situation that went bad.

As you can see hedging is not the cardinal sin that it is often made out to be. The times you should avoid hedging is when the stakes are within your normal bet sizing (unless with no regard to your initial bet, on its own, the other side becomes +EV). The bad reputation hedging gets is somewhat deserved, because people put themselves into hedge scenarios for the wrong reason. Betting a team to win Super Bowl instead of conference, or division. Blindly over betting large favorites and cutting losses, adding more teams to parlays etc. If you avoid these and do it right, again, it does often make sense to hedge your bets.

How to Calculate a Hedge Stakes?

This is all simple algebra. Let's say you have $100 staked on +800. The $100 is sunk, it is already in the pot so to speak. If the bet wins you get back that $100 stake, and you get the $800 winnings too, for a $900 return. Calculating hedge stakes is always based on the return. Let's now say the other side is -465. The question is: how much do we need to bet on -465 for stake plus win to equal the same $900 return?

Most sports bettors are aware (and if you're not please read: How Sports Betting Works) that when American odds are negative you can calculate the payout on any stake by dropping the negative sign, moving decimal over 2 places, and then dividing it by stake. For example $100 staked on -465 is $100/4.65=$21.51. Therefore $100 on bet -465 is risk $100 to win $21.51. Okay so our hedge stake equation is going to include the 4.65 for the -465 and is going to include the $900 return. Ordering this is pretty simple. That equation is:

STAKE+(STAKE/4.65)=$900

The math to solve that is simple, but if you're presently void of grade 6 algebra skills, use an algebra.com calculator to solve that. Call stake A and format the equation as A+A/4.65=900. Using that algebra.com link, you'll see A (stake)= $740.71. This gives us two bets.

– Bet 1 = $100 to win $800 (that's a $900 return).

– Bet 2 = $740.71 to win 159.29 (that's also a $900 return).

No matter which side wins we get $900 back. All together we've staked $100 on bet 1 + $740.71 on bet 2 for a total of $840.71. So no matter which team wins we now profit $900-$840.71=$59.29. We've hedged our bet in full.

Hedging 3 Way Lines

Hedging wagers with 3 or more options to bet is no different. Let's say for a soccer match the odds are:

Home: +129

Draw: +258

Away: +229

We bet $2,000 on +129 as we calculated a huge edge. Then we find out we made a mistake. There are star players out, and now is breaking news other players are going to rest too. We decide we want off this position in a hurry. How do we hedge? Well our first bet was $2,000 to win $2,580. The return is therefore $4,580. To hedge we need to bet the amount that has stake plus win total $4,580 on each of the other options.

In this case where dealing with positive American odds so payouts calculate as stake+(stake*odds)=payout. Note: odds are the American odds with decimal moved over 2 places.

On +258 our equation is:

A+(A*2.58)=4580

Which solves to A (stake) = 1279.33

On +229 our equation is:

A+(A*2.29)=4580

Which solves to A (stake) = 1392.10

We now have 3 bets.

– Bet 1 = Risk $2,000 to win $2,580 (that's a return of $4,580)

– Bet 2 = Risk $1,279.33 to win 3300.67 (that's also a return of $4,580)

– Bet 3 = Risk $1,392.10 to win 3187.91 (that's a return of $4,580.01)

Add the risks amounts of each (2,000+1,279.33+1392.10) and see we have 4671.43 at risk. We get back $4,580 no matter which team wins. As $4,580-4671.43=-91.43 we can see we've now hedged off the $2,000 we once had at risk, and are taking a $91.43 loss no matter if home wins, away wins, or it is a draw.

There are many calculators that can be found searching Google that will do the math for you in calculating a hedge stake. For more advanced users you can find spread sheets for using Excel solver. As this article is in our beginners section, the purpose here was to just give a solid introduction to sports betting hedge bets.

Author: Jim Griffin

If you have heard of the term ‘hedging your bets' then this calculator will allow you the opportunity to do precisely that.

The Hedge Bet Calculator (also sometimes known as the Lay Calculator) is a way of betting on both markets (to win and not to win) in such a way to ensure that regardless of the outcome, you will make a profit.

Gambling Hedge Calculator

How to use the Hedging Bet Calculator

There are three sections to the Hedging Bet Calculator and we'll explain how to complete each one below:

Top Section: Entering Bet Details and Commission

In this top section of the calculator, you need to enter in the bet details and also whether the bookmaker charges any commission on backing (which is unusual – hence the default setting of 0%) or laying (which is more common, usually between 1% and 5%) a selection.

In the first box, you enter details of the price that you backed the selection to win, which must be entered using decimal odds format (so odds of 2/1, would be entered as 3.0).

Gambling Hedge Calculator Estimate

After that, you enter in how much you have staked on that selection to win.

In the next box, you enter what the lay price of your selection is once again in decimal format; this is the price you are backing the selection not to win at.

Once you have entered that price, you then need to enter any commission that you would need to pay to the bookmaker when backing (in the Back box) or laying (in the Lay box). You do this simply by selecting the appropriate percentage rate from the dropdown box.

It is important that you do state the correct commission percentages for both boxes as incorrectly entering them could potentially leave you out of pocket.

The great thing about this Hedging Calculator is that once you have entered all the details, the calculator automatically updates, showing you all the information you need to know in the two sections below.

Middle Section: The Results

The middle section of the Hedging Calculator displays the main results of the data you have entered in the top section.

Gambling Hedge Calculator Present Value

The first box details how much money you should lay in order to ensure you make a profit on the event in question. The second box shows you how much profit you would be guaranteed to make on the market overall, if you back the selection and lay against it.

Another example is having 5% of your bankroll on a 1 to 5 favorite. The game doesn't start well, and you end up using in-play betting to lock in a 1% loss. In this case by hedging you surrendered 1% of your bankroll to safe guard the 4% that was previously at risk.

The above scenarios are reasonable for even professional bettors to find themselves in. In this article I provide the math for calculating hedge stakes, and also discuss when it is strategically correct to do so. First, I cover another frequent hedging scenario that is almost exclusive to novice bettors. As this is a very common mistake I go into detail explaining it.

Hedging Parlay Bets

As a moderator of one betting forum, and a long time regular posters on others, I often see posts that are along the lines of:

'I bet $100 on a 6 team parlay (accumulator) that pays 45/1. The first five teams have won and the other is playing tonight. Should I bet their opponent at -110 to lock in a guaranteed win? If so for how much?'

It is very common for recreational bettors to add an additional team to their parlays with the intention of hedging it back should it get that far. If you are someone who does this, please read closely.

Understand that a parlay bet is nothing more than rolling a stake plus win forward again and again. Let's look how it works on $100 using 6 bets with American odds -110.

– Bet1: $100 to win $90.91 – if win you have $190.91

– Bet2: $190.91 to win $173.55– if win you have $364.46

– Bet3: $364.46 to win $331.33 – if win you have $695.79

– Bet4: $695.79 to win $632.54 –if win you have $1,328.33

– Bet5: $1,328.33 to win $1,207.57 –if win you have $2,535.91

– Bet6: $2,535.91 to win $2,305.37 – if win you have $4,841.27

If you win all 6 you have 48.41 times you stake. As 1 was your stake this means the payout is 47.41 to 1 which in American odds is +4741. At Bovada, 5Dimes, and Bookmaker this is exactly what a 6 teamer pays when all point spreads are -110. However, there are other sites that essentially cheat players by using fixed odds. Examples include BetOnline who pays 45/1 and Topbet 40/1 on 6-teamers. This is legit as each has these payouts built it into their rules, but it is this way only to take advantage of novice bettors that don't know any better. www.bovada.lv is a much better choice.

So, the first mistake was likely getting +4500 when +4741 was available. But, even if you had the full pay ($100 to win $4,741.27), let's look what happens when you hedge. In order to lock it in so the profit is the same no matter which team wins you'll now need to stake $2,535.90 on their opponent winning at American odds -110.

This gives two bets. These are:

– Bet 1 = $100 to win $4741.27

– Bet 2 = $ 2,535.90 to win $2,305.36

If Bet 1 wins, on the winning bet you get +$4741.27 and -$2535.90 on the losing one = +$2,205.37

If Bet 2 wins you get +$2305.36 on the winning one and -$100 on the losing one = +$2,205.36

Aside from the penny that can't be split, you've now hedged in such a way the profit is the same regardless of which team wins. Now here's the kicker. Go back up to where I showed manually rolling forward stake plus win and note: 'Bet5: $1,328.33 to win $1,207.57 –if win you have $2,535.91'. Do you see what a huge mistake adding extra teams to parlays only to hedge is?

If you had bet a 5-team parlay $100 turns to $2,535.91 when all 5 win. By adding a sixth team and then hedging it back, instead those same five teams winning gives you a return of only $2,205.36. That is $330.55 thrown away for no reasons at all.

Please note that even when dealing with moneyline parlays where each has different odds the result is the same. It doesn't matter the order or anything else. The parlay payout is the same as rolling over stake plus win on each bet, no matter what odds you select.

If you're in this scenario now, then perhaps you should hedge. This is covered in the next section. Just hopefully this section has resulted in lesson learned and you will avoid getting into the same situation in the future.

When Does Hedging Make Sense

Anytime the stakes involved are significant a hedge is ideal. There is a lot of poor advice on forums that explain otherwise by stressing the importance of expected value. This is where understanding Kelly Criterion helps. In that article, in laymen terms I explain the importance of maximizing expected growth (EG) over expected value (EV). This is also how advanced bettors should determine their hedge stakes. That aside, here are some general bullet points.

When to Hedge:

1) When the second wager is also +EV

This can happen for a variety of reasons. Perhaps you found an arbitrage situation and are betting both simultaneously. Perhaps, you're watching television and see a player is injured and can act in those few seconds before the in-play betting odds adjust.

2) When hedging was a consideration before you placed your original bet

There are countless reasons to make over-bets. Perhaps you see a line of -6.5 in a football match and strongly suspect it will move to -7, but probably won't move to -6. Here you might over-bet with the plan to buy it back later for a profit or for a +EV middle attempt. There are many other scenarios with future bets, live trading on betting exchanges, etc. where hedging was a known option at the time the original bet was placed.

3) Anytime you're overexposed

Again, this can be from foolishly adding additional teams to parlays. It might also be because an outside circumstance required you to reduce your bankroll while bets were pending. It could also be that an arbitrage or over-bet situation that went bad.

As you can see hedging is not the cardinal sin that it is often made out to be. The times you should avoid hedging is when the stakes are within your normal bet sizing (unless with no regard to your initial bet, on its own, the other side becomes +EV). The bad reputation hedging gets is somewhat deserved, because people put themselves into hedge scenarios for the wrong reason. Betting a team to win Super Bowl instead of conference, or division. Blindly over betting large favorites and cutting losses, adding more teams to parlays etc. If you avoid these and do it right, again, it does often make sense to hedge your bets.

How to Calculate a Hedge Stakes?

This is all simple algebra. Let's say you have $100 staked on +800. The $100 is sunk, it is already in the pot so to speak. If the bet wins you get back that $100 stake, and you get the $800 winnings too, for a $900 return. Calculating hedge stakes is always based on the return. Let's now say the other side is -465. The question is: how much do we need to bet on -465 for stake plus win to equal the same $900 return?

Most sports bettors are aware (and if you're not please read: How Sports Betting Works) that when American odds are negative you can calculate the payout on any stake by dropping the negative sign, moving decimal over 2 places, and then dividing it by stake. For example $100 staked on -465 is $100/4.65=$21.51. Therefore $100 on bet -465 is risk $100 to win $21.51. Okay so our hedge stake equation is going to include the 4.65 for the -465 and is going to include the $900 return. Ordering this is pretty simple. That equation is:

STAKE+(STAKE/4.65)=$900

The math to solve that is simple, but if you're presently void of grade 6 algebra skills, use an algebra.com calculator to solve that. Call stake A and format the equation as A+A/4.65=900. Using that algebra.com link, you'll see A (stake)= $740.71. This gives us two bets.

– Bet 1 = $100 to win $800 (that's a $900 return).

– Bet 2 = $740.71 to win 159.29 (that's also a $900 return).

No matter which side wins we get $900 back. All together we've staked $100 on bet 1 + $740.71 on bet 2 for a total of $840.71. So no matter which team wins we now profit $900-$840.71=$59.29. We've hedged our bet in full.

Hedging 3 Way Lines

Hedging wagers with 3 or more options to bet is no different. Let's say for a soccer match the odds are:

Home: +129

Draw: +258

Away: +229

We bet $2,000 on +129 as we calculated a huge edge. Then we find out we made a mistake. There are star players out, and now is breaking news other players are going to rest too. We decide we want off this position in a hurry. How do we hedge? Well our first bet was $2,000 to win $2,580. The return is therefore $4,580. To hedge we need to bet the amount that has stake plus win total $4,580 on each of the other options.

In this case where dealing with positive American odds so payouts calculate as stake+(stake*odds)=payout. Note: odds are the American odds with decimal moved over 2 places.

On +258 our equation is:

A+(A*2.58)=4580

Which solves to A (stake) = 1279.33

On +229 our equation is:

A+(A*2.29)=4580

Which solves to A (stake) = 1392.10

We now have 3 bets.

– Bet 1 = Risk $2,000 to win $2,580 (that's a return of $4,580)

– Bet 2 = Risk $1,279.33 to win 3300.67 (that's also a return of $4,580)

– Bet 3 = Risk $1,392.10 to win 3187.91 (that's a return of $4,580.01)

Add the risks amounts of each (2,000+1,279.33+1392.10) and see we have 4671.43 at risk. We get back $4,580 no matter which team wins. As $4,580-4671.43=-91.43 we can see we've now hedged off the $2,000 we once had at risk, and are taking a $91.43 loss no matter if home wins, away wins, or it is a draw.

There are many calculators that can be found searching Google that will do the math for you in calculating a hedge stake. For more advanced users you can find spread sheets for using Excel solver. As this article is in our beginners section, the purpose here was to just give a solid introduction to sports betting hedge bets.

Author: Jim Griffin

If you have heard of the term ‘hedging your bets' then this calculator will allow you the opportunity to do precisely that.

The Hedge Bet Calculator (also sometimes known as the Lay Calculator) is a way of betting on both markets (to win and not to win) in such a way to ensure that regardless of the outcome, you will make a profit.

Gambling Hedge Calculator

How to use the Hedging Bet Calculator

There are three sections to the Hedging Bet Calculator and we'll explain how to complete each one below:

Top Section: Entering Bet Details and Commission

In this top section of the calculator, you need to enter in the bet details and also whether the bookmaker charges any commission on backing (which is unusual – hence the default setting of 0%) or laying (which is more common, usually between 1% and 5%) a selection.

In the first box, you enter details of the price that you backed the selection to win, which must be entered using decimal odds format (so odds of 2/1, would be entered as 3.0).

Gambling Hedge Calculator Estimate

After that, you enter in how much you have staked on that selection to win.

In the next box, you enter what the lay price of your selection is once again in decimal format; this is the price you are backing the selection not to win at.

Once you have entered that price, you then need to enter any commission that you would need to pay to the bookmaker when backing (in the Back box) or laying (in the Lay box). You do this simply by selecting the appropriate percentage rate from the dropdown box.

It is important that you do state the correct commission percentages for both boxes as incorrectly entering them could potentially leave you out of pocket.

The great thing about this Hedging Calculator is that once you have entered all the details, the calculator automatically updates, showing you all the information you need to know in the two sections below.

Middle Section: The Results

The middle section of the Hedging Calculator displays the main results of the data you have entered in the top section.

Gambling Hedge Calculator Present Value

The first box details how much money you should lay in order to ensure you make a profit on the event in question. The second box shows you how much profit you would be guaranteed to make on the market overall, if you back the selection and lay against it.

This information is summarised in the next two boxes. The Total Staked box outlines how much you would need to wager in total on backing and laying against the selection, while the guaranteed return box, shows you how much you'd win if your lay against selection wins.

The Bottom Section: The Summary – Profit / Loss

Aus Sports Betting Hedge Calculator

The final section of the calculator simply summarises what your profit and liabilities are for each possible outcome of the event you have decided to back and lay against a selection in.

In the first section, Wins, this outlines how much money you would win from the bookmaker from backing your selection, together with how much you would lose from laying against that selection winning.

The second section, Losses, shows how much money you would make if your backed selection does not win (Lay Profit), together with how much you would stand to lose (Back Liability).

In both cases, you should find that the Back Profit and Lay Profit columns offer a positive return over the liability columns. If they do, then regardless of the outcome of the event in question, between your two wagers, you will turn a profit.